work in process inventory balance formula

Once you sell the finished goods transfer the. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of.

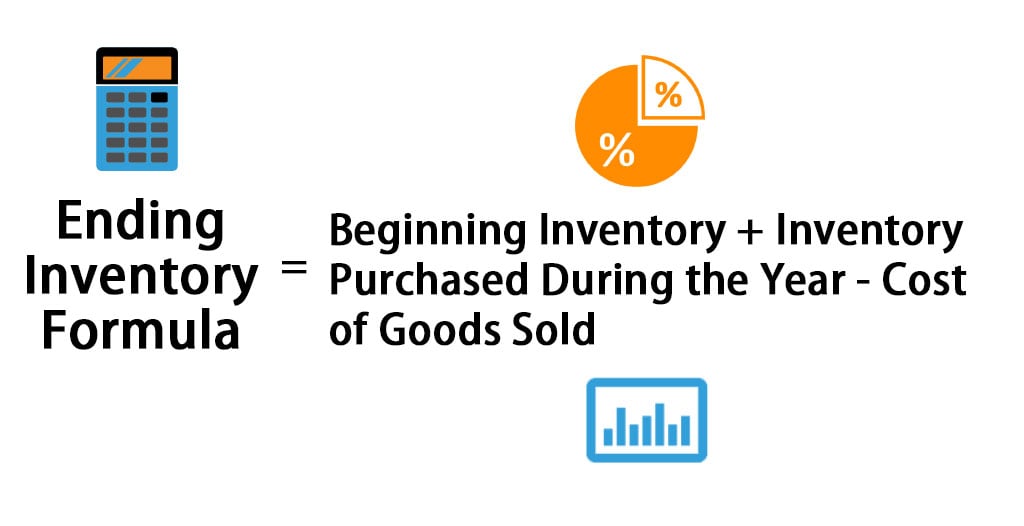

Ending Inventory Formula Step By Step Calculation Examples

WIP inventory is considered an inventory asset and as it moves through the stages of production it becomes part of the cost of sales.

. The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet. Since WIP inventory takes up space and cant be sold for a profit its generally a best. Raw Materials Direct Labor Costs Manufacturing Overhead Manufacturing Costs.

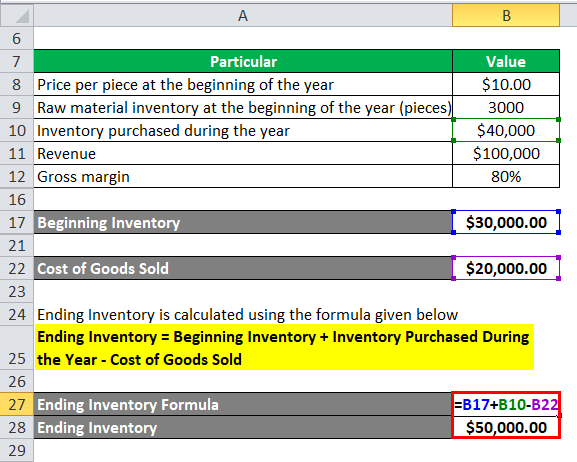

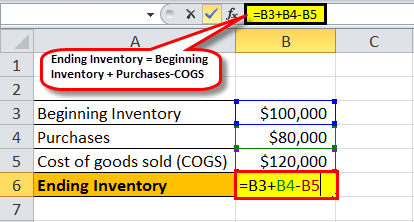

During the remaining financial year the company has made purchases amounting 20000 and during that time on the companys income statement the cost of goods sold is 40000. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity. The current cycles beginning WIP inventory cost should be the exact same as the last cycles ending WIP inventory cost.

Regardless of the type of inventory control process you choose decision-makers know they need the right tools in place so they can manage their inventory effectively. Work in process inventory formula. A work in process or WIP for short is the term that refers to any inventory thats been initiated into production but hasnt been completed by the end of a companys accounting cycle.

Your cost of finished goods is. Calculate the ending Work in Process Inventory balance on June 30. Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory.

In this manner how do you calculate ending work in process inventory balance. Inventory Formula Example 1. Once you know your beginning WIP inventory manufacturing costs and COGM you.

This product value is important for financial reporting. Part 1 of 3. Let say company A has an opening inventory balance of 50000 for the month of July.

An important note to consider is that work in process inventory can vary greatly. Ending work in process. Inventory accounting is an important aspect of your fulfillment process because the cost of buying and storing a product is a major factor in your asset.

This leaves the company with an ending WIP inventory balance of 4500. The work-in-process inventory that a company has started but not completed has specific value. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods.

The factory overhead costs can be calculated for the accounting period. Deduct the cost of raw material from this figure that is on hand at the end of the accounting period to determine the costs of materials consumed during the accounting period. As per the Merriam-Webster dictionary Work-in-process WIP refers to a component of a companys inventory that is partially completed.

100000 150000 150000 100000. Force can be calculated with the formula Work F D Cosineθ where F force in newtons D displacement. Work in progress WIP sometimes referred to as work in process is the sum of all costs put into the production.

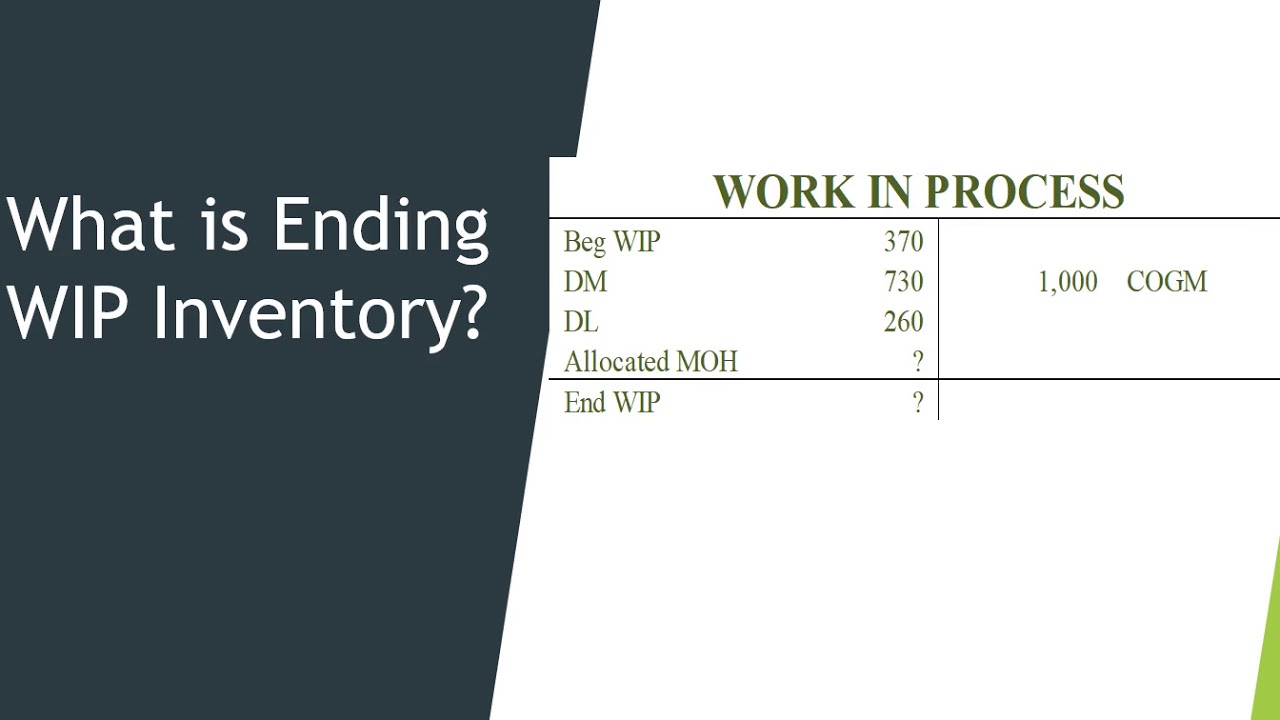

Definition formula and benefits. Beginning WIP Manufacturing costs - Cost of goods manufactured. The calculation of ending work in process is.

30 x 5000 150000. The beginning WIP inventory is a type of carryover from the last accounting periods balance sheet. Your manufacturer also produced 5000 pairs of shoes each costing around 30 to produce on average.

Any part product or item thats used to make merchandise inventory is listed on a companys balance sheet. Work In-process Inventory Example. Below is the data table.

In this case for example consider any manufactured goods as work in process. The labor costs for the accounting period should be calculated. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory.

The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. WIP is a concept used to describe the flow of manufacturing costs from one area of production to the next and the balance in WIP represents all production costs incurred for partially completed goods. The more WIP inventory that goes through the production process the higher the raw materials and labor costs will be which will impact the total costs of manufactured goods.

As determined by previous accounting records your companys beginning WIP is 115000. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs. Work In Progress - WIP.

Yes work in process WIP inventory is considered inventory. The value of your businesss inventory is constantly changing as products are received assembled stored and sold. Work in process WIP inventory refers to materials that are waiting to be assembled and sold.

Furthermore what does work in process mean. Work in process WIP work in progress WIP goods in process or in- process inventory are a companys partially finished goods waiting for completion and eventual. WIP Inventory Example 2.

Production costs include raw materials labor used in making goods and allocated overhead. WIP inventory includes the cost of raw materials labor and overhead costs needed to manufacture a finished product. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory.

Cost of manufactured goods. From there you would calculate ending WIP inventory amount. The value of that partially completed inventory is sometimes also called goods in process on the balance sheet particularly if the company is manufacturing tangible items rather than providing services.

The formula is as followed. Beginning WIP DM DL MOH. Imagine BlueCart Coffee Co.

Under this method the cost of completed units is. Understanding Work in Process Inventory. Click to see full answer.

Some inventory might have one stage of machining done and other inventory might have all but one stage of machining done. Whether to reference us in your work or not is a personal decision. During the year 150000 is spent on manufacturing costs along with your total cost of finished goods being 205000.

How To Calculate Finished Goods Inventory

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Work In Progress Wip Definition Example Finance Strategists

Ending Inventory Formula Step By Step Calculation Examples

What Is Work In Process Wip Inventory How To Calculate It Ware2go

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Wip Inventory Definition Examples Of Work In Progress Inventory

Ending Inventory Formula Calculator Excel Template

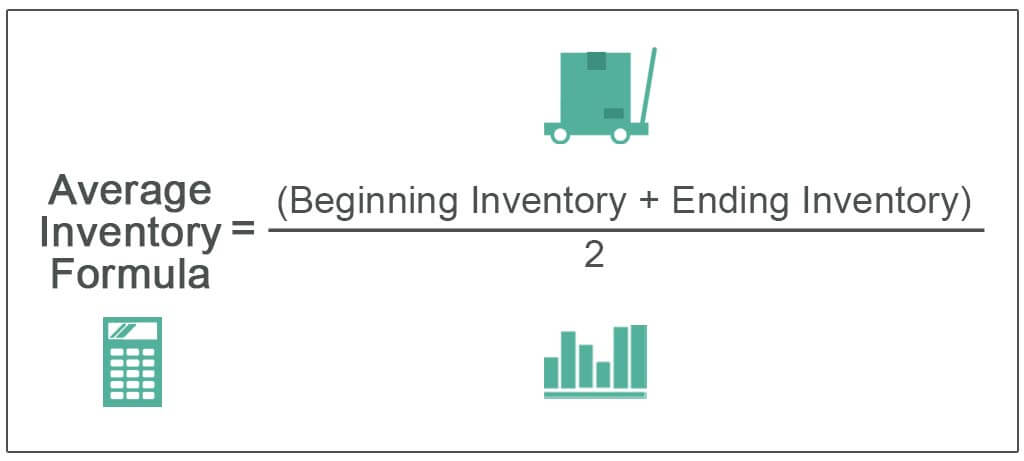

Average Inventory Formula How To Calculate With Examples

Work In Process Wip Inventory Youtube

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Work In Process Inventory Formula Wip Inventory Definition

Solved Calculate The Ending Work In Process Inventory Chegg Com

Inventory Formula Inventory Calculator Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com